PNC Mobile Accept

Role: Content Designer

Tools: InVision, Figma, The Hemingway App, Oxford Learner’s Dictionaries

Overview

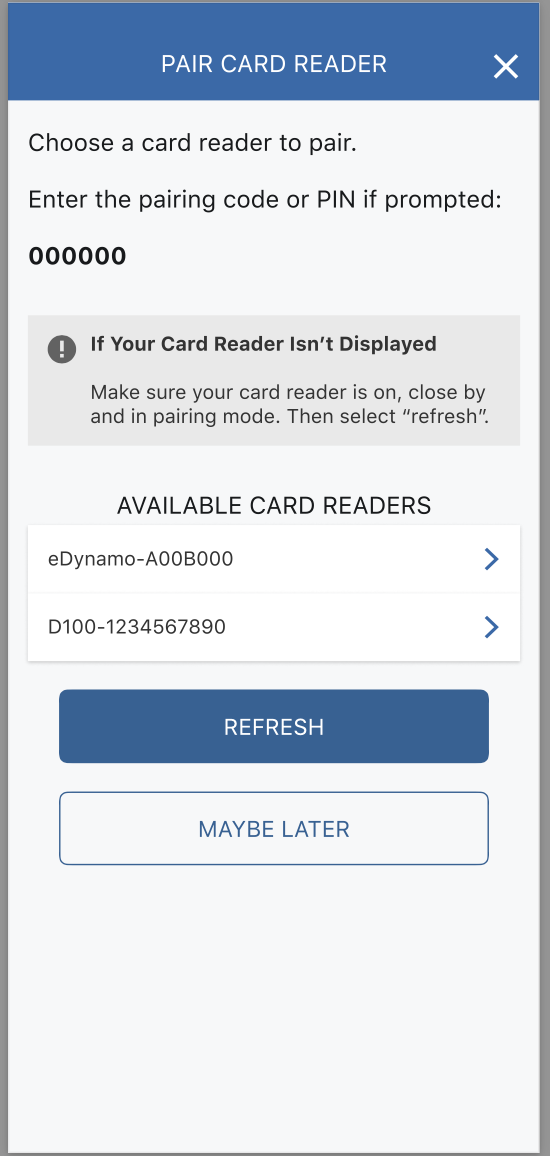

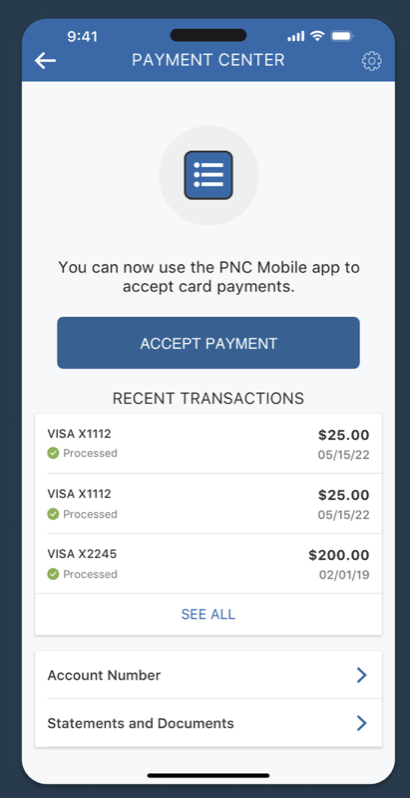

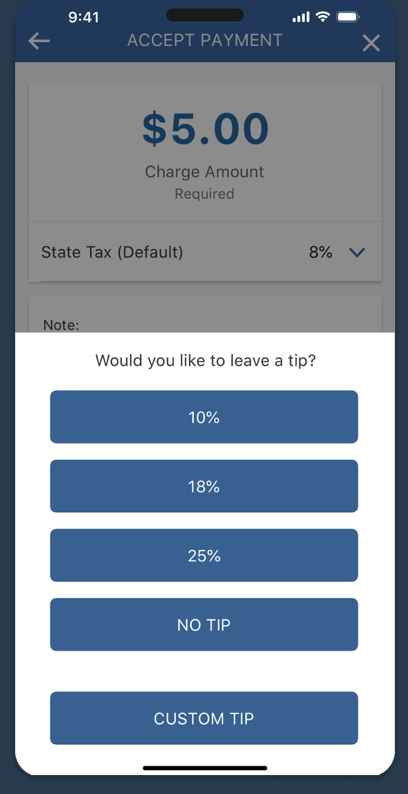

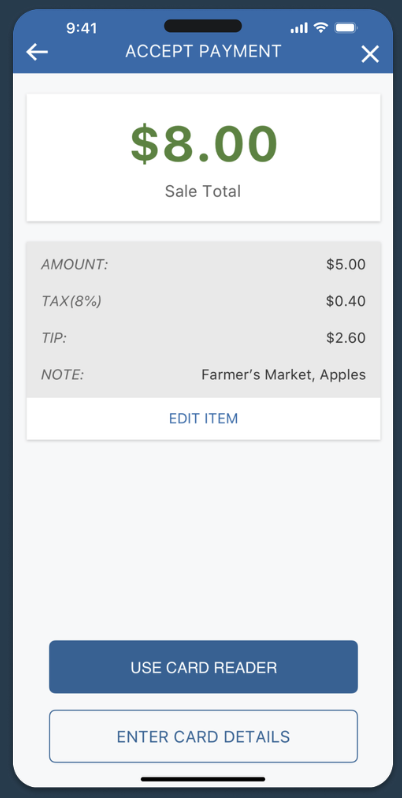

Mobile Accept is a card processing feature available to business banking clients within PNC Bank’s mobile app. It allows merchants to accept card payments on the go using a Bluetooth® card reader paired to their mobile devices.

My role involved research, collaborating with the product team to provide content designs, and working with accessibility and governance partners to ensure Mobile Accept was inclusive, user friendly and met strict legal standards.

The Problem

PNC relied on Clover®, a 3rd party solution, to provide small business clients with a mobile card processing solution. This created an inconvenience for PNC’s clients by requiring them to transition between the Clover and PNC mobile apps for their card processing and business banking tasks.

To solve for this and remain competitive in the merchant services market, PNC decided to build its own mobile payment processing solution: Mobile Accept.

Users

Mobile Accept was designed for merchants without an online store, physical storefront or designated payment counter to accept card payments from their customers. These are merchants like:

Flea market and trade show vendors

Food truck operators

Mobile pet groomers

Hair stylists

Restaurant owners

Contractors

Process

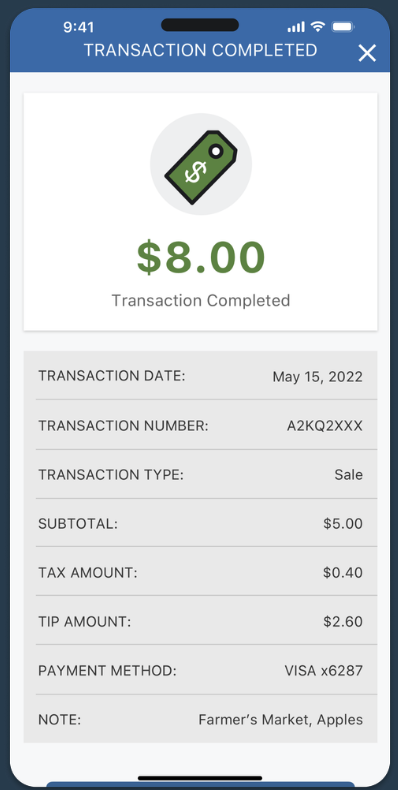

Simplified the end-to-end experience

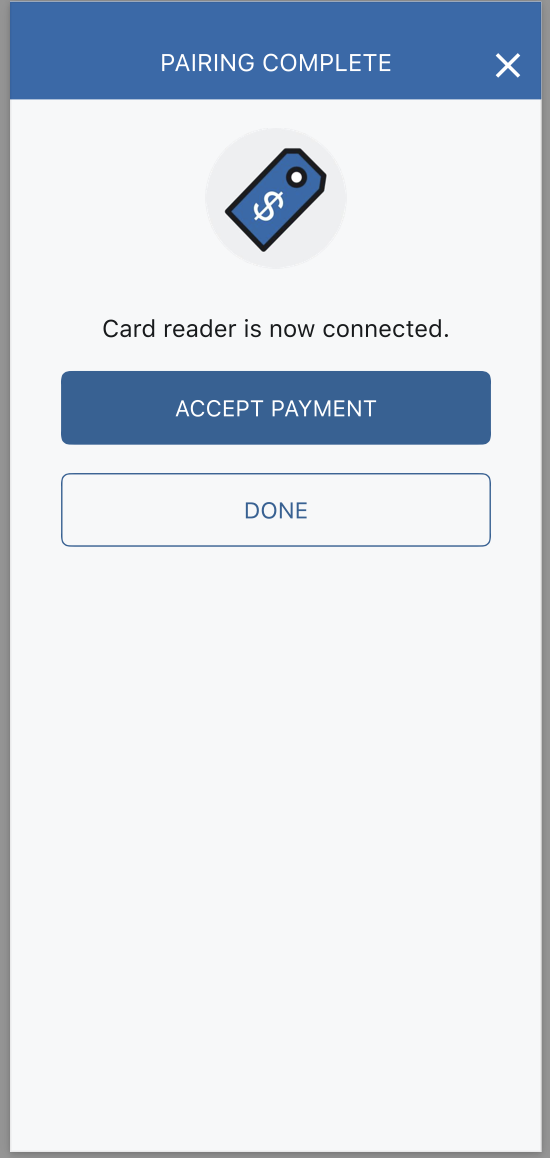

Worked with designers and PMs in content workshops and design reviews to refine voice, tone, and clarity across the experience. Targeted a 6th–8th grade reading level to support quick, on-the-go comprehension.

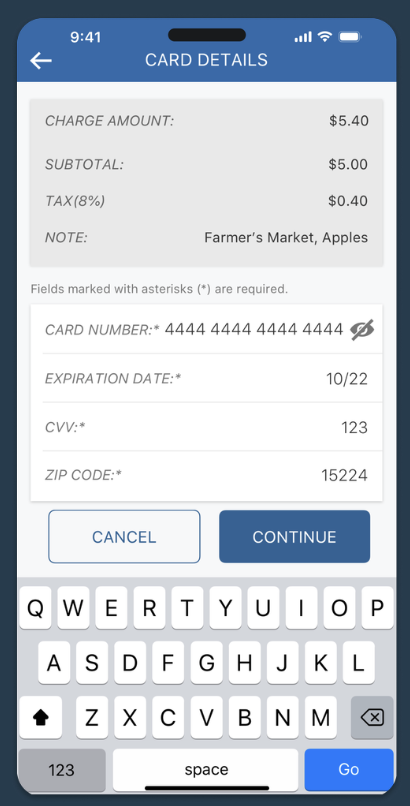

Designed for neurodiverse and ESL merchants

Evaluated every line of copy with accessibility and cognitive load in mind. Used the Oxford Learner’s Dictionary to replace complex terms with elementary to intermediate (A1–B2) vocabulary whenever possible.

Clarified required technical language

For unavoidable industry terms, partnered with design to add helper text and tooltips so merchants could understand concepts without friction.

Tested and tightened readability

Used Hemingway, an online readability tool, to ensure the content aligned with plain language standards and could be scanned quickly.

Grounded content in real merchant language

Reviewed competitor walk-throughs (Chase QuickAccept, Square) and combed through social posts from small business owners to mirror how merchants naturally talk about card processing. Applied those insights to labels, instructions, and transactional messaging.

Maintained alignment with PNC content standards

Cross-checked all copy against PNC’s digital content guidelines and collaborated with other content designers to ensure consistency across product lines.

Results

Merchant testing showed that Mobile Accept felt intuitive and simple to navigate, helping business owners move through key payment flows quickly. As the product rolled out and continued to evolve, we saw meaningful impact: underwriting conversion improved by about 20%, and the enhanced copy and flows supported a 2% increase in transacting users, 6–8% week-over-week transaction growth, and over one million completed transactions.